Venezuela set to issue national cryptocurrency

Venezuela set to issue national cryptocurrency

Bitcoin, the flourishing and hugely popular cryptocurrency, has increased in value by an estimated 1500% since the start of the year, a fact that has pushed many investors and speculators across the globe to pursue a single-minded quest to accumulate and trade as much of the controversial digital currency as possible.

Surging to well over $15,000 from off the back of news that Bitcoin futures will soon be offered on Nasdaq and other big stock exchanges, Bitcoin dropped back down to near $14,000 in its historically volatile fashion, before once more rallying to just over $15,000. In South Korea, where cryptocurrency trading is especially popular, Bitcoins have been trading at up to $19,000.

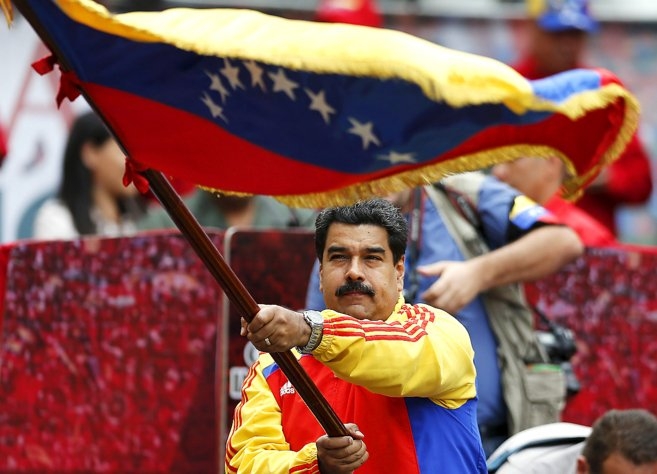

No doubt encouraged by the ongoing rise in value of Bitcoin and the continuing emergence of a host of other cryptocurrencies, Nicolas Maduro, The President of Venezuela, announced that the South American country will establish their own digital currency named simply the ‘Petro’, in an effort to help stabilise their ailing economy which has been subject to a US led financial blockade for several years.

Add the fact that the number of those using bitcoin in Venezuela went from around 450 in 2014 to approximately 100,000 in 2017 mainly due to the falling price of oil, which is the country's main asset. Top it all off with the vicious hyperinflation and it seems as though Venezuela has nothing to lose in pioneering a state-backed cryptocurrency.

The national currency, the Bolivar, has depreciated by over a whopping 55% against the US dollar over the course of just this year. The estimated average monthly wage in Venezuela presently works out at a clearly unsustainable amount of less than $4.30.

Courtesy of Reuters, the photo beneath shows a waiter counting out notes, not from a whole day's takings, but for a lunchtime meal for four. Hyperinflation has practically rendered the Bolivar close to worthless.

Although unlikely to be of immediate help to those suffering worst from the conditions on the ground in Venezuela, it is hoped that by creating the ‘Petro’, a national digital currency with state-backing, that transactions with the outside world can resume once more at regular levels. These transactions became increasingly difficult since the start of sanctions by the Obama administration a few years back, something that has had a profoundly negative effect on the Venezuelan economy.

Unlike Bitcoin, whose value is largely determined by its increasing utility, its market and its traders, the ‘Petro’ will be backed by Venezuelan state reserves of gold, diamonds, oil and other valuable natural resources, giving it far more stability than cryptocurrencies that work like Bitcoin.

President Maduro stated, “Venezuela will create a cryptocurrency... the ‘petro’, to advance in issues of monetary sovereignty, to make financial transactions and overcome the financial blockade”.

Maduro’s announcement was met by disbelief by many commentators and opposition politicians who claim the statement is just an act of showmanship in a desperate effort to garner support from Venezuelan businessmen and industry. However, if successful in their bold venture to establish the first ever openly state-backed cryptocurrency, Venezuela’s step into the world of digital finance could see many other states around the world follow suit.

The rise of cryptocurrencies is seen as one of the biggest threats to the US dollar, also known as the petrodollar, in remaining the most widely used and traded currency across the globe. Cryptocurrencies such as Bitcoin have been hailed by commentators as both a phenomenon that will revolutionise the financial system for the better, but also as a dangerous and highly speculative addition to the world of money and finance.